W2 Printable Form

- 4 December 2023

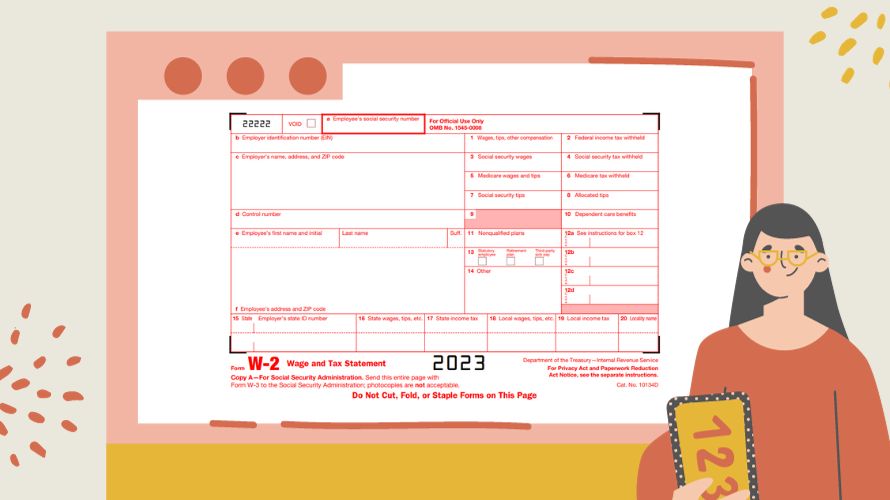

When tax season approaches, preparing yourself with the right documentation is essential. The W-2 tax form is a critical piece, as it details your annual wages and the taxes withheld from your paycheck. Familiarizing yourself with the W-2 tax form printable will ensure you file your taxes confidently. The form is divided into multiple sections, labeled with alphabetical and numerical designations, which report everything from your Social Security Benefits to Medicare and Social Security taxes withheld.

Seamless Steps to Fill Out Printable W-2 Form

To help you easily navigate the completion process, we've compiled a bullet-pointed guide. By following these steps, you can rest assured that your W-2 form will be accurate and compliant:

- Start by gathering your employment information from the past year, including your total wages and the taxes withheld.

- Employers must provide a W-2 form, so ensure you obtain the blank W-2 form printable from your employer or download it from a reliable online source.

- Accurately enter your personal information in the labeled boxes at the top of the form, including your name, address, Social Security number, and employer's identification number (EIN).

- Fill out the boxes corresponding to your financial details, ensuring you correctly report your wages, tips, other compensation, and federal and state income taxes withheld.

- Verify all the information to prevent discrepancies that could delay your tax processing or result in penalties.

Guide to the W2 Printable Form Submitting

Once your printable W2 form is filled in accurately, you must submit it to the IRS. The process entails a simple yet important set of steps to ensure it reaches the IRS without any issues:

- If you have a paper copy of your printable W2 form to the IRS, send it to the appropriate address found on the instructions, depending on your state.

- Alternatively, you can submit your W-2 form electronically. The IRS encourages electronic submissions as they are processed faster, which can expedite any potential tax refund.

- Remember to retain a copy of your printable W-2 form for 2023 for your records, as it will be needed for future reference or in case of an IRS audit.

Deadline for the W-2 Form Submission

Mark your calendar for the last date to submit your W2 printable form for free without penalties. Employers must send W-2 forms to employees and the Social Security Administration by January 31, following the tax year. If you, as an individual taxpayer, are mailing the form, ensure it is postmarked by this date. For electronic submissions, confirm the form is transmitted before midnight on the day of the deadline. This timely action is crucial in maintaining good standing with the IRS and avoiding unnecessary fines or complications.

Tax preparation need not be a daunting task. By understanding the W-2 form layout, attentively following these step-by-step instructions, and being mindful of the submission deadline, you'll be ready to navigate tax season like a pro.